During these years, we have been connecting investors with diverse entrepreneurs in their fundraising activity.

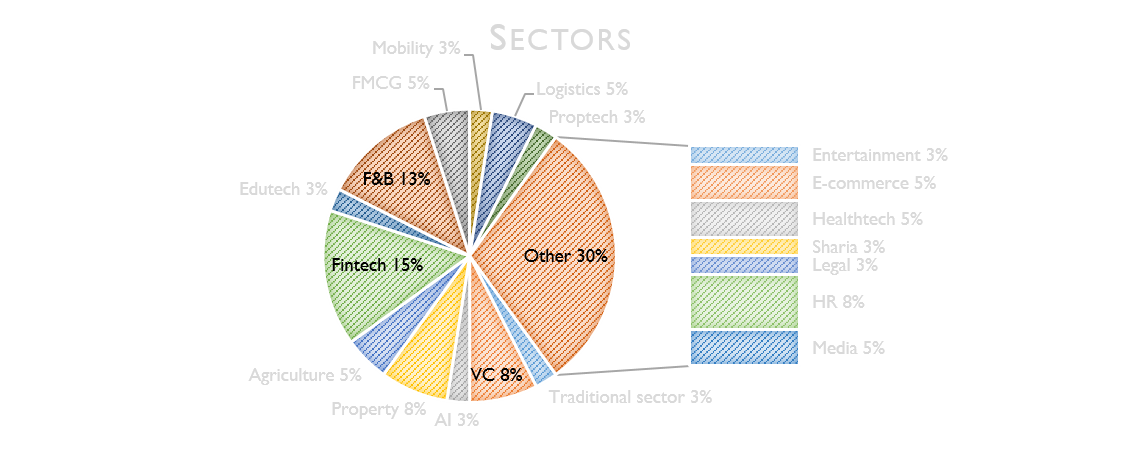

The sectors of the entrepreneurs that we assisted range from the traditional sectors, technology, tech-enabled sectors to venture capitals. The biggest proportion is the financial technology and F&B sectors.

In broad terms, enterprises can be categorized as B2B and B2C. We have quite a balanced B2B and B2C breakdown of enterprises.

and with diverse funding stages from Series Seed to Series C, reflecting the diversity of maturity of the companies we advise and refer. The majority is in Series A, the followed by Series B and Series Seed. We have a small portfolio of Series C companies.

We have been helping many entrepreneurs on a long term basis, from their infancy where they have not been generating revenue or profit, to generating revenue but not profitable to generating revenue and profitable. Until the entrepreneurs could become cash-flow positive, they will need funding.

On the other hand, our diverse investor profile combined with our knowledge in fundraising makes it more likely for companies to succeed in their fundraising quests.

We look forward to continue to connecting and advising investors and diverse entrepreneurs. Click here to see how we can help your enterprise get the investment you need.